With more than six months having passed since the Level 1 SFDR disclosures came into force The European Commission (EC) has released more ESG regulatory updates, clarifying sustainability objectives which will impact investment product design and client advising.

Barclays and Goldman Sachs Equity Research teams have released their analysis.

- The Sustainable Finance Disclosure Regulation (SFDR), required fund managers to classify each of their funds into one of three categories depending on their sustainability objective

- Article 6: products do not claim to promote any kind of ESG objective

- Article 8 (‘light green’) – These products promote an environmental or social characteristic but do not have sustainable investment as their objective (ie, they still take ESG criteria into account in the investment process)

- Article 9 (‘dark green’) – a financial product has sustainable investment as its objective

SFDR intentionally leaves the classification of ESG products up to the asset manager

Barclays ESG Research (based on Morningstar Direct) reports that the current classification breakdown of European AUM is:

Article 6 – Non ESG 64% AUM

Article 8 – Light Green 33% AUM

Article 9 – Dark Green 4% AUM

SFDR classification now has large implications for fund flows as Article 8 and 9 (ESG) funds are becoming the preferred products amongst clients, leaving Article 6 (non-ESG) funds likely to miss out on new AUM flows. Additionally, Goldman Sachs Equity Research, see a classification shift of non-ESG funds (Article 6) towards ESG and reclassifying funds to Article 8

The classification challenge for asset managers

Given the commercial driver to classify as ESG and capture flows, product categorisation as ESG (Article 8 or 9) remains a point of challenge internally for many asset managers, and Goldman Sachs research finds certain managers have been considerably more cautious than others when making fund classification decisions.

Marketing and Distribution departments want to market Green credentials to capture new business into ESG funds.

Portfolio managers have to walk the marketing talk, however this can require a change to the investment process they have used historically. ESG characteristics need to be considered alongside financial characteristics when selecting stocks and targeting portfolio returns.

Conflicting motivations and processes can lead to friction, and introduce risk.

Product and Compliance teams sit in the middle and are required to justify the SFDR classification measuring the holdings in the portfolio relative to the ESG classification.

The risk of being labelled Greenwashing is real. The implications of being accused of Greenwashing is not only reputational, as seen with DWS / Deutsche, but the litigation risk is keeping Compliance Officers up at night.

Reaching an SFDR ESG classification

The approach to Article 9 classification (Dark Green) is quite clear and only 4% of funds apply this.

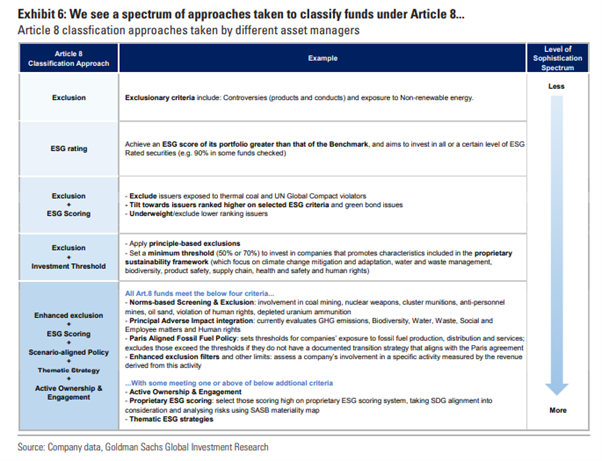

Approaches to classifying funds under Article 8 (Light Green), however, have varied in sophistication, as summarised by Goldman’s below:

Regulators have responded, with stricter rules to classify ESG funds now emerging from Member States. German regulators are proposing minimum sustainable investment threshold and exclusions, while France’s AMF already requires ESG funds to exclude 20% of the investable universe based on ESG factors.

SFDR reporting and ESG integration requires the disclosure inputs from investee companies / holdings. Further disclosure at the corporate level will continue to improve fund scoring and the ESG investment process. The European Commission (EC) has issued further guidance on:

EU Taxonomy: is becoming a key feature of all ESG capital market regulation in Europe. EU Taxonomy reporting for corporates becomes effective 1 Jan 2022. This will, in time, lead to international spillover and put pressure on non-EU companies to voluntarily disclose Taxonomy alignment.

All investment funds classified as Article 8 or 9 under SFDR will need to report under the EU Taxonomy starting 1 Jan 2022.

Corporate Sustainability Reporting Directive (CSRD): This will set common European reporting rules with the aim to ensure increased transparency, requiring companies to report sustainability information in a consistent and comparable manner.

Expected to apply from 2023, and reporting is subject to external audit.

The new CSRD reporting proposal would expand the scope of covered companies from ~11,000 currently to ~49,000, covering all listed companies and potentially privates.

Recent Comments