Are you part of a younger generation of investors, or new to investing? Do you feel that short term political thinking is preventing an adequate global response to the climate crisis?

You want your investments to matter, and to make a positive difference to the world we live in. You can choose to invest in causes that are important to you, such as climate change. Companies and investment funds are now measured by criteria such as ESG, enabling you to direct your investments into an area you feel will make a positive difference.

Ultimately, there are various ways for your investments to be directed in ways that support the environment and favour positive ESG scores and sustainability:

- Passive funds that track an ESG benchmark, such as MSCI All World ESG index.

- Mutual funds that exclude certain sectors or companies from its investments (e.g. controversial weapons, coal mining)

- Mutual funds that align to ESG by favouring companies with positive ESG scores

- Thematic funds or ETF’s that aim to pick tomorrow’s winners. E.g. LGIM Hydrogen economy, or iShares Clean Energy

- You can direct your pension fund allocation towards ESG investment strategies

- Invest in start ups that could provide solutions to real world problems.

Let’s take a closer look at the case for sustainable investing

Why is ESG and sustainable investing happening now ?

ESG stands for environmental, social, and governance.

Environmental events around the world are increasing the awareness and concerns of climate change and global warming. Enormous wildfires in USA and Australia, droughts, melting icecaps in the Artic and Antarctic, are all punishing symptoms of global warming, which will only get worse if our behaviour does not change.

In response to this, 196 countries have adopted The Paris Agreement, a legally binding international treaty on climate change. Its goal is to limit global warming to well below 2, preferably to 1.5 degrees Celsius, compared to pre-industrial levels.

The United Nations Panel on Climate Change (IPCC), claims that to have a chance of keeping global warming to 1.5 degrees, global emissions need to reach net zero by 2050.

To meet these stated climate goals, government policies of these 196 countries will have to implement the net zero carbon goals.

China has a plan to be carbon neutral by 2060. UK, France and New Zealand are planning to be carbon neutral by 2050.

This is a catalyst for economic and social transformation.

The virtuous circle of investing

Companies set corporate strategy to align with country targets and government legislation, and begin to transition their business where required. Company transition initiatives require investment (capex) and funding.

The initiative behind the energy transition results in new solutions to a global problem, creating business opportunities.

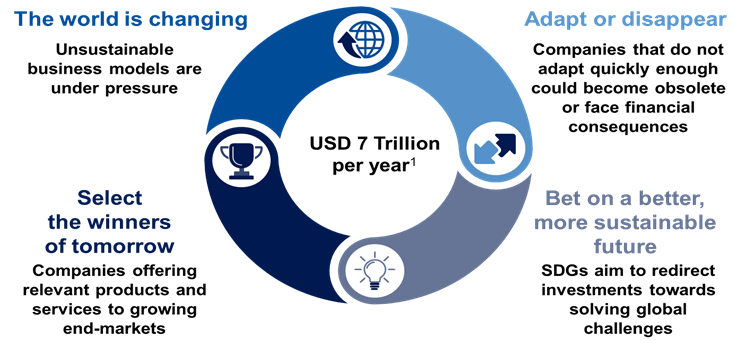

It is estimated that between $3-7 Trillion per year of investment is required to support the energy transition.

What role do your personal investments play?

On the other side of new business start ups in the sustainability space is a wall of money looking to invest in real world solutions. Beyond the Bond market, venture capital and private equity, your pension fund and personal investments are searching for new ideas to provide backing with financial investment.

You can invest in the world you want to see

As the world is changing, there is a greater need to understand the risks or opportunities we face from ESG issues and the economic and social transformation.

Start with 2 core investment considerations:

- Avoiding the financial risks associated with negative ESG events

- Invest in the winners of tomorrow

ESG investing is not just about your view of a better world. Amongst the economic and social transformation there will be winners and there will be losers.

What do we mean by ESG ?

ESG measures the sustainability and societal impact of an investment in a company, and can help to determine the future financial performance of the company.

Environmental criteria [E]

- Currently, climate change and the move toward net-zero greenhouse gas (GHG) emissions by 2050 dominates the agenda. But [E] also includes a company’s use of energy, waste, pollution, and natural resource conservation.

Social criteria [S]

- These criteria comprise how a company manages relationships with its stakeholders, including employees, suppliers, customers, and the communities it operates in. The COVID-19 pandemic has emphasized the interconnection between sustainability and the financial system.

Governance criteria [G]

- These criteria incorporate how a company’s leadership operates in relation to policies on audits, diversity, executive pay, illegal practices, inclusion, internal controls, and shareholder rights, and their willingness to engage in the sustainability reporting process.

Case study: ESG Investment Risk – Stranded asset – Coal

Coal fired electricity plants in NSW Australia are being closed because it is now cheaper to produce electricity from solar and wind, rather than coal.

ESG considerations play an important role in protecting downside risk in your portfolio.

Stranded assets are those that must be unexpectedly or prematurely written down because the economic returns on the asset are no longer present. About 50% of the world’s fossil fuel assets will be worthless by 2036 under a net zero transition, according to research at the University of Exeter.

Companies extracting fossil fuels face the threat that consumers are switching to alternative energy, due to their contribution towards global warming and government regulations.

Australia’s supply of electricity is already transitioning away from a predominantly coal-based supply to a larger mix of renewable electricity, as renewable energy sources become cheaper than coal (even without government subsidies).

Origin Energy announced plans to shut Australia’s biggest coal-fired power plant in 2025, seven years earlier than scheduled, as an influx of wind and solar power has made the plant uneconomic to run.

“The reality is the economics of coal-fired power stations are being put under increasing, unsustainable pressure by cleaner and lower cost generation, including solar, wind and batteries,” Origin Energy Chief Executive Frank Calabria

Including ESG in investment decisions can help avoid companies that risk losing value due to the transition to cleaner energy.

Case study: ESG Opportunity – picking the winners of tomorrow – Tesla

The energy transition is providing investment winners.

Tesla is an American electric vehicle and clean energy company established in 2008. Tesla designs and manufactures electric cars, battery energy storage from home to grid-scale, solar panels and solar roof tiles, and related products and services.

Tesla share price was around $50 in late 2019, and has since skyrocketed to $1,000 in 2022, as a result of being a leading player in the development and mass production of electric vehicles.

How can you incorporate ESG into your investments ?

Consider what is appropriate for your growing investment portfolio

- Funds that track an ESG benchmark, or have sector exclusions

- Thematic ETF’s that aim to pick tomorrow’s winners

- See if your pension fund is allocated towards ESG investment strategies

- Look out for start ups who are solving real world problems.

Recent Comments